- #Ynab 4 no online how to#

- #Ynab 4 no online trial#

- #Ynab 4 no online plus#

Nothing is worse than running into an emergency and struggling to decide how you will pay for it. The Mvelopes app will do most of the hard work for you by organizing all your income and expenditures in one easy-to-access dashboard. Learn to save for the things you want, rapidly pay off your debt, and keep it paid. Plan ahead for your children’s college funds or set money aside for a second car. Organize every paycheck for monthly bills, groceries, entertainment, etc.

Four-Step Approach – Similarly to YNAB, Mvelopes provides users with a set “plan” to follow to guarantee financial success:. Reduce Your Debt – With a tailored plan to your situation, tackling your debt is easier than ever.

Four-Step Approach – Similarly to YNAB, Mvelopes provides users with a set “plan” to follow to guarantee financial success:. Reduce Your Debt – With a tailored plan to your situation, tackling your debt is easier than ever.  Real-Time Budgeting – With all of your accounts in one place, you can see where your money is within minutes before you spend. Unlimited Accounts – Connect all of your bank accounts, loan information, credit cards, etc., to one Mvelopes account so you can see all of your income and debt in the same place.

Real-Time Budgeting – With all of your accounts in one place, you can see where your money is within minutes before you spend. Unlimited Accounts – Connect all of your bank accounts, loan information, credit cards, etc., to one Mvelopes account so you can see all of your income and debt in the same place. #Ynab 4 no online how to#

Mvelopes offers some great features that will help you understand banking better and teach you how to become more financially independent:

#Ynab 4 no online trial#

(Currently, Mvelopes is offering a free 30-day trial for their Premier plan if you wanted to try it out.) Mvelopes Features

#Ynab 4 no online plus#

The Premier plan is $9.97 per month, while the Plus plan is $19.97 per month. The basic subscription for Mvelopes costs $5.97 per month. This budgeting app helps you see what spending areas you have money in and where your money is dwindling to give you a better sense of how you need to spend your money. Mvelopes models this process to create a new, virtual way of envelope budgeting. It works just like if you were to put away physical money in labeled envelopes, only allowing that cash to be spent for that specific purpose. Mvelopes’ budgeting tools will take you back to the old days of financial planning and spending. This includes understanding YNAB’s four rules better, learning how to save and budget, and many other important financial topics.

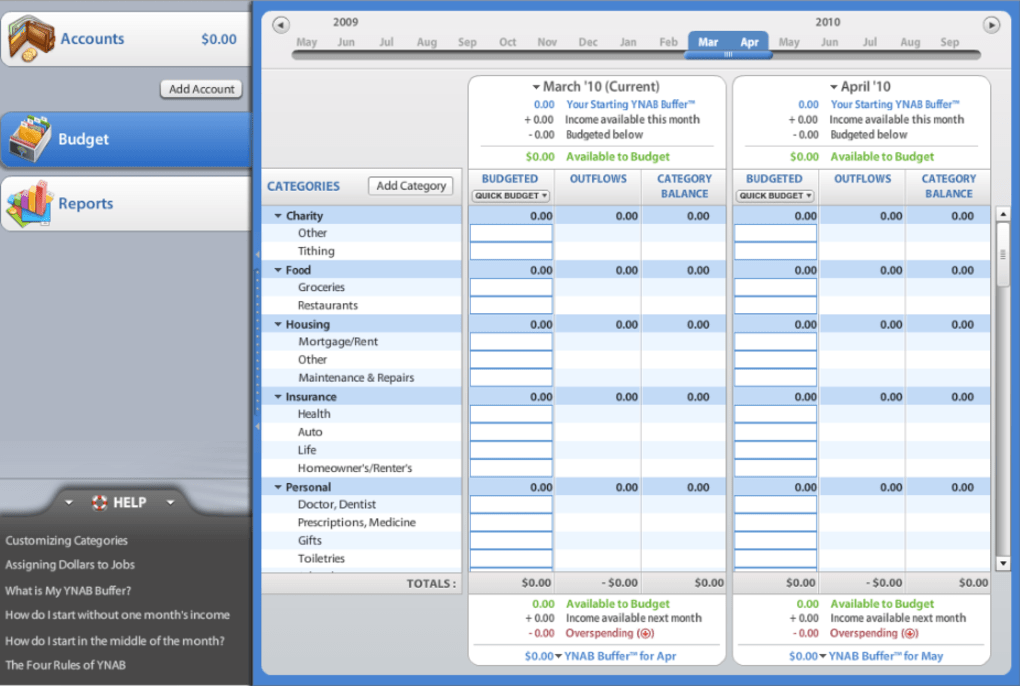

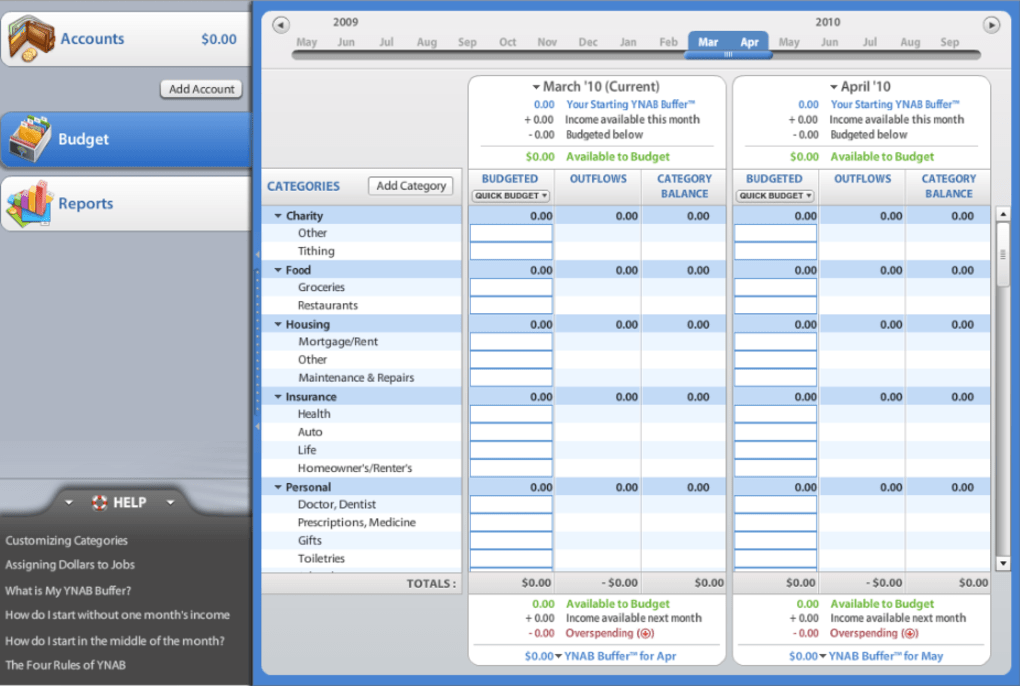

Free Live Workshops – Every day, YNAB offers their users 20-minute live workshops to help them learn the art of finances with professionals. Budgeting Together – YNAB allows couples and families to work together to create a budget that will make everyone happy and have the ability to access it from all devices, no matter where you go. You won’t have to worry about paycheck-to-paycheck budgeting. Once you are on your way to success with the first three rules, you will be able to save money to put towards future spending. If you overspend in one category, simply make up for it by reducing your spending in another. Break down more considerable infrequent expenses like holiday gifts and car maintenance into a monthly payment to set aside. Make a list of where every penny of your paycheck should be placed, whether towards a bill, food, or entertainment. Set Rules for Successful Budgeting – YNAB provides users with four essential rules to follow when setting and managing their budget:. Here are a few of YNAB’s features to give you a better idea of what they offer and how they can help you and your family get ahead financially: You probably wonder exactly how this company differs from the rest of the budgeting apps out there. There’s also a free 34-day trial if you want to test it out before committing to the platform. Getting started with YNAB requires a subscription, at $11.99 a month or $84 annually. It simply allows you to take control of your finances your way while helping you understand your budget. It’s not like other financial apps that make you feel guilty about where your money is spent or tells you when you overspend. This app has been designed specifically to make you aware of where every penny you spend is going and allows you to stay involved in your budget. Now that we know the purpose of these applications, let’s discuss the pros and cons of two popular budgeting programs: YNAB and Mvelopes. Give you a visual idea of how your money is being spent. Identify monthly subscriptions and other recurring billing that is not being used.

There are multiple ways in which a budgeting app can help you save and never overspend mindlessly again. These apps help you layout your monthly spending versus your income and will track every cent you are handing out (zero based budgeting). That’s where a budgeting program comes in. There are many situations where consumers are literally wasting money every month and not even noticing. A budget app or program is designed to help you see where your money is going and how you can spend more mindfully. When you decide you are ready to get help from budgeting software, you are starting your journey to financial freedom.

0 kommentar(er)

0 kommentar(er)